Empowering Rural India: Spandana’s ₹400 Crore Capital Infusion

Spandana Sphoorty Financial Limited (SSFL) stands at the forefront of India’s microfinance revolution, serving 2.8 million women across 328 districts. With its 2025 Rights Issue, this NBFC-MFI aims to strengthen its rural lending ecosystem while capitalizing on India’s $50 billion microcredit opportunity. This comprehensive guide delivers critical insights – from financial deep dives to step-by-step application processes – empowering you to make informed decisions about this pivotal capital raise.

Inside Spandana’s Rural Finance Ecosystem

The Microfinance Powerhouse

SSFL operates through three strategic verticals:

- Core MFI Operations: Income-generation loans to women (avg. ticket: ₹36,000)

- Chetana JLG Model: Joint Liability Groups ensuring 98.7% repayment rate

- Subsidiary Services:

- Criss Financial: SME loans & Loan Against Property (LAP)

- Nano-enterprise financing through 1,238 branch network

Market Position:

| Metric | SSFL | Industry Avg |

|---|---|---|

| AUM (Mar 2025) | ₹12,869 Cr | ₹3,200 Cr |

| Borrower Growth (3-Yr) | 18.4% CAGR | 12.1% CAGR |

| Geographic Coverage | 18 States | 8-12 States |

| ROA (FY24) | 1.94% | 1.25% |

Source: MFIN India Report 2025

Rights Issue 2025 – Critical Details

Capital Raise Structure

| Parameter | Detail |

|---|---|

| Issue Period | Aug 1 – Aug 11, 2025 |

| Issue Size | ₹400 Crores |

| Shares Offered | 1,73,91,304 |

| Issue Price | ₹230/share |

| Face Value | ₹5/share |

| Entitlement Ratio | 10 Rights Shares for every 41 held |

| Payment Terms | ₹115 on application + ₹115 call |

| Listing | BSE, NSE (Expected: Aug 14, 2025) |

Financial Health Assessment

Performance Snapshot (₹ Crores)

| Period | AUM | Revenue | PAT | Net Worth |

|---|---|---|---|---|

| Mar 2022 | 6,863.69 | 1,391.60 | 46.64 | 2,962.43 |

| Mar 2023 | 9,185.64 | 1,394.45 | 12.34 | 2,972.19 |

| Mar 2024 | 12,869.58 | 2,406.91 | 46.79 | 3,484.69 |

Key Improvement Drivers

- AUM Growth: 87% expansion in 2 years

- NIM Expansion: 10.2% (2024) vs 8.7% (2022)

- GNPA Control: 1.8% (Mar 2024) vs industry 3.2%

- Cost-to-Income: 56.4% (improved from 62.1% in 2023)

Data Source: SSFL Investor Presentation Q4 2025

Capital Utilization Strategy

Fund Allocation Breakup

| Purpose | Amount (₹Cr) | Impact |

|---|---|---|

| Micro-Lending Expansion | 320 | 500K new borrowers |

| Technology Integration | 45 | AI-driven credit assessment |

| Tier-3 City Expansion | 35 | 200 new branches |

Expected Outcomes:

- 22-25% AUM CAGR over FY26-FY28

- Reduction in cost of funds by 85-100 bps

- Digital loan processing time under 48 hours

Investment Thesis – 5 Compelling Factors

- Rural Consumption Boom: 37% increase in rural credit demand (NABARD 2025)

- Portfolio Quality: <2% GNPA vs industry average 3.5%

- Valuation Opportunity: Trading at 1.2x P/B vs 5-yr avg of 2.8x

- Government Synergy: PM Mudra Yojana beneficiary with 68% aligned portfolio

- Technical Positioning: 45% discount to 52-wk high with strong RSI support

Application Masterclass

Step-by-Step Process

- Eligibility Check (As of July 24, 2025)

- RE Acceptance (Demat: Accept/Reject/Renounce via broker)

- Payment Structure:

- Application: ₹115 per share via ASBA

- Final Call: ₹115 payable within 6 months

- Renunciation Process:

- Trading Window: Aug 6, 2025 (9:15 AM-3:30 PM)

- Symbol: SPANDANA-RE on NSE/BSE

- Post-Submission Tracking:

- Registrar Portal: KFinTech Dashboard

- Helpline: 040-67162222

Tax Implications

| Action | Tax Treatment |

|---|---|

| Renunciation Profit | Short-Term Capital Gains (15%) |

| Rights Shares Sale | STCG if sold <12 months |

| LTCG (10% >₹1L) if held >12 months |

Risk Radar

Sector Challenges:

- Regional monsoon volatility impacting repayment

- Interest rate sensitivity (75% loans floating rate)

- Political risks in state-specific farm loan waivers

Company-Specific Concerns:

- Debt/Equity at 5.8x (Post-issue target: 4.2x)

- Andhra/Telangana contribute 52% portfolio

- Subsidiary Criss Financial’s NPA at 4.1%

Mitigation Strategies:

- Geographic diversification to East/North-East

- Collateral-backed loans through Criss (42% portfolio)

- Weather-indexed insurance coverage for agri-loans

Expert Recommendation

Verdict: CAUTIOUS SUBSCRIPTION FOR LONG-TERM HOLDERS

- Existing Shareholders: Participate to avoid 19.3% dilution

- New Investors: Exposure to rural finance at discounted valuation

- Avoid If: Seeking short-term gains or risk-averse

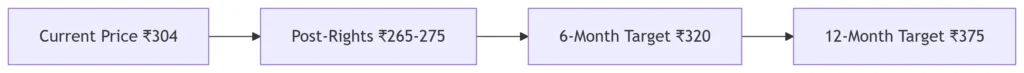

Price Projection:

Company & Registrar Information

Spandana Sphoorty Financial Ltd

Galaxy, Wing B, 16th Floor, Raidurg Panmaktha

Hyderabad 500081

☎️ +91-40-4547475

✉️ investor.relations@spandanasphoorty.com

🌐 Investor Corner

Registrar:

KFin Technologies Limited

🏢 Selenium Tower B, Plot 31-32, Gachibowli

📞 040-79611000

📧 einward.ris@kfintech.com

🔍 Rights Issue Status

10 Essential FAQs

- Q: What’s the minimum application cost?

A: ₹115 per share upfront (50% payment) - Q: Can NRI shareholders participate?

A: Yes, through RBI-compliant portfolios - Q: How will EPS be impacted?

A: Short-term dilution; FY27 EPS projected at ₹28.5 (vs ₹24.1 in FY25) - Q: Where to download RHP documents?

A: BSE Website or Company Investor Page - Q: What’s the capital adequacy post-issue?

A: Projected at 26.4% vs current 22.1% - Q: When are final call payments due?

A: Within 6 months of allotment (Notification by Feb 2026) - Q: How to apply without demat account?

A: Physical applications through designated branches (list in LOA) - Q: What percentage of shares are pledged?

A: 18.2% of promoter holding - Q: Are loans secured?

A: MFI loans unsecured; Criss subsidiary loans 64% secured - Q: How does this compare to 2022 QIP?

A: 23% lower issue price; funds for growth vs previous debt reduction

The Road Ahead

Post-Issue Growth Strategy:

- FY2026: Expand to 400 new talukas in Bihar/Jharkhand

- FY2027: Achieve 40% digital sourcing of loans

- FY2028: Reduce cost-to-income ratio below 50%

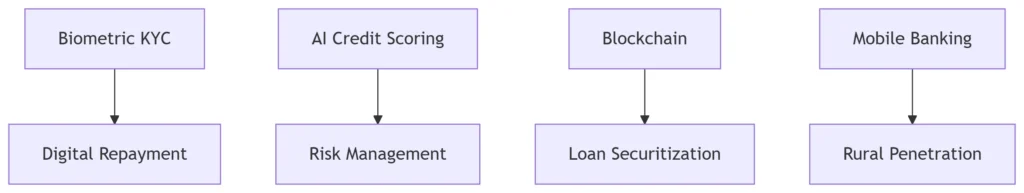

Technology Integration:

Conclusion: Banking on Bharat’s Growth

Spandana’s Rights Issue presents a calibrated opportunity to invest in India’s financial inclusion story at a pivotal moment. While high leverage and regional concentration pose near-term challenges, the company’s established rural network, improving asset quality, and favorable sector tailwinds create compelling long-term potential. Existing shareholders should participate to maintain their stake proportion, while new investors could consider selective exposure through renounced entitlements. With microfinance poised to grow at 22% CAGR through 2030, this capital raise could fuel Spandana’s next growth phase.